When it comes to planning a successful event, one of the most crucial elements is creating and managing an effective event budget. The event budget serves as the foundation for all your financial decisions, ensuring that your event’s expenses are well-organized and aligned with your overall goals. In this comprehensive blog post, we will explore the steps involved in creating an event budget, from setting financial goals to tracking and managing expenses.

Importance of Creating an Event Budget

Crafting an event budget is essential for several reasons:

1. Financial Oversight

A well-structured budget provides you with a clear and comprehensive understanding of your event’s financial landscape. It allows you to identify potential areas of overspending, make informed decisions, and maintain control over your event’s finances.

2. Realistic Planning

By creating an event budget, you can accurately estimate the resources required to execute your event successfully. This enables you to set realistic expectations, allocate funds appropriately, and avoid unexpected financial challenges.

3. Cost-Effectiveness

A detailed budget helps you identify opportunities to streamline expenses, negotiate better deals with vendors, and maximize the value of your event investments. This can lead to significant cost savings and a more efficient use of your resources.

4. Transparency and Accountability

A transparent event budget promotes accountability among your team, vendors, and stakeholders. It ensures that everyone involved in the event planning process is on the same page and works towards achieving the financial goals.

Setting Financial Goals

Before delving into the specifics of your event budget, it’s essential to establish clear financial goals. These goals will serve as a guiding light throughout the budgeting process, ensuring that your financial decisions align with your overall event objectives.

1. Defining the Event Scope

Begin by clearly defining the scope of your event, including the type of event, the number of attendees, the venue, and the duration. This information will help you determine the scale and complexity of your event, which will directly impact your budget.

2. Identifying Revenue Sources

Determine the potential revenue sources for your event, such as ticket sales, sponsorships, vendor fees, and any other sources of income. Estimating these revenue streams will help you identify the available funds and set realistic financial targets.

3. Establishing a Budget Range

Based on your event scope and potential revenue sources, set a budget range that aligns with your overall financial goals. This range should include both a minimum and a maximum budget, giving you the flexibility to adjust your plans as needed.

4. Prioritizing Spending Areas

Identify the key areas of your event that require the most significant financial investment, such as venue rental, catering, entertainment, and marketing. Prioritize these areas and allocate funds accordingly to ensure the successful execution of your event.

Identifying Expenses

Once you have established your financial goals, the next step is to identify all the potential expenses associated with your event. This comprehensive list will serve as the foundation for your event budget.

1. Venue and Facility Costs

This category includes the rental fees for the event venue, any additional spaces required (e.g., breakout rooms, green rooms), and any setup or tear-down fees.

| Expense Item | Estimated Cost |

|---|---|

| Venue Rental | $10,000 |

| Breakout Room Rental | $2,000 |

| Setup and Tear-Down Fees | $1,500 |

2. Catering and Hospitality

Catering expenses may include the cost of food, beverages, service staff, and any necessary equipment or rentals.

- Catering (including service staff)

- Beverages

- Tableware and Linens

- Bartender and Bar Supplies

3. Entertainment and Production

This category covers the costs associated with any entertainment, speakers, or production elements, such as audio-visual equipment, lighting, and stage design.

- Keynote Speakers

- Musical Performers

- Audio-Visual Equipment and Technicians

- Staging and Decor

4. Marketing and Promotion

Expenses in this category may include the costs of advertising, printed materials, digital marketing, and any other promotional activities.

- Advertising (print, digital, radio)

- Promotional Materials (brochures, flyers, signage)

- Event Website and Online Presence

- Social Media Marketing

5. Logistics and Staffing

This category encompasses the costs of event staff, transportation, and any other logistical requirements.

- Event Coordinators and Assistants

- Security Personnel

- Parking and Shuttles

- Permits and Licenses

6. Miscellaneous Expenses

Finally, be sure to allocate funds for any unexpected or miscellaneous expenses that may arise during the event planning process.

- Contingency Fund

- Insurance

- Taxes and Fees

Allocating Funds

After identifying all the potential expenses, it’s time to allocate your available funds to the various budget categories. This process requires careful consideration and a deep understanding of your event’s priorities and constraints.

1. Prioritizing Expenses

Rank your expenses in order of importance, based on their impact on the overall success of your event. This will help you determine which areas require the most significant financial investment and which can be adjusted or reduced if necessary.

2. Balancing the Budget

Distribute your available funds across the various budget categories, ensuring that the allocation aligns with your financial goals and the prioritized expenses. This may involve making trade-offs and compromises to ensure that your event remains within your budget.

3. Incorporating Flexibility

Build in some flexibility within your budget to account for unexpected expenses or changes in the event planning process. This can be achieved by allocating a portion of your budget to a contingency fund or by leaving some room for adjustments within certain expense categories.

4. Securing Additional Funding

If your initial budget is insufficient to cover all your expenses, explore options for securing additional funding, such as sponsorships, grants, or crowdfunding campaigns. This can help you bridge the gap and ensure the successful execution of your event.

Tracking and Managing Expenses

Effective budget management is crucial throughout the event planning process. Regularly tracking and monitoring your expenses will help you maintain control over your finances and make informed decisions.

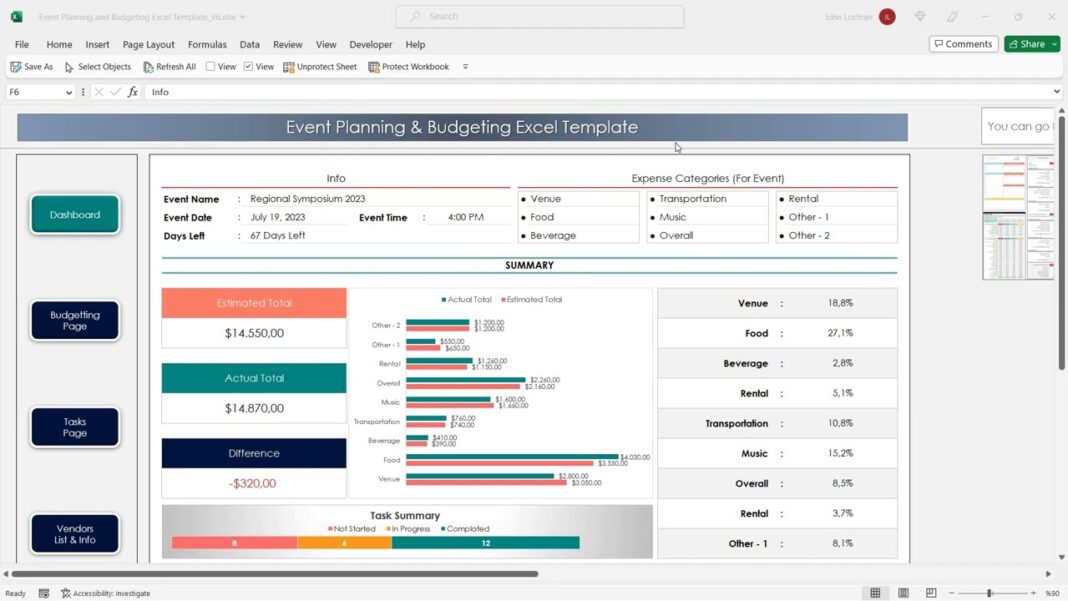

1. Establishing a Tracking System

Develop a comprehensive tracking system that allows you to record all expenses, categorize them, and compare them to your budgeted amounts. This can be done using spreadsheets, budgeting software, or specialized event management tools.

2. Ongoing Expense Monitoring

Regularly review your expense tracking system to identify any discrepancies or potential areas of overspending. This will enable you to make timely adjustments and take corrective actions to stay within your budget.

3. Vendor and Supplier Management

Maintain clear communication with your vendors and suppliers, ensuring that you receive accurate invoices and that your payments are made on time. This can help you avoid any unexpected charges or late fees.

4. Budget Adjustments

Be prepared to make adjustments to your budget as needed, based on changing circumstances or new developments. This flexibility will allow you to adapt to challenges and capitalize on any opportunities that arise during the event planning process.

Tips for Staying Within Budget

Adhering to your event budget can be a challenging task, but with the right strategies and mindset, you can successfully manage your finances and ensure the success of your event.

1. Negotiate with Vendors

Leverage your negotiation skills to secure the best possible deals with your vendors and suppliers. This may involve negotiating lower prices, securing discounts, or securing more favorable payment terms.

2. Seek Cost-Saving Alternatives

Explore alternative options that may be more cost-effective without compromising the quality of your event. This could include finding a less expensive venue, opting for in-house catering, or exploring DIY solutions for certain event elements.

3. Utilize Technology

Leverage technology to streamline your budget management process. Use budgeting software, expense tracking apps, and online project management tools to simplify your financial record-keeping and decision-making.

4. Maintain Transparency

Foster a culture of transparency within your event planning team and with your stakeholders. Regularly communicate your budget updates and seek their input to ensure that everyone is aligned and committed to staying within the allocated funds.

5. Allocate a Contingency Fund

Set aside a portion of your budget as a contingency fund to cover any unexpected expenses or unforeseen circumstances. This will provide you with a financial buffer and help you avoid going over budget.

Conclusion

Creating and managing an effective event budget is a crucial aspect of successful event planning. By setting financial goals, identifying expenses, allocating funds, and tracking expenses, you can ensure that your event is executed within your available resources. Remember to stay flexible, negotiate with vendors, and leverage technology to streamline your budget management process. By following these strategies, you can create an event budget that aligns with your goals and ensures the success of your event.